gambling winnings tax calculator nj

Tax rates depend on your annual income and tax bracket. 8 for Lottery payouts over.

Gambling Winnings Tax How Much You Will Pay For Winning The Turbotax Blog

New Jersey is a true Promised Lands to gamblers offering a huge variety of betting sites new online casinos in NJ and even poker.

. No tax on lottery winnings of 10000 or less. For example lets say you elected to. New Yorkers with winnings in New Jersey or other states may be required to file a non-resident return if gambling winnings exceeded 5000.

Gambling Winnings Tax Calculator Nj - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. In contrast New Jerseys full-month sports gambling tax collection was about 8 million. Gambling Winnings Tax Calculator Nj.

New Jersey Gambling Tax Calculator. Even if that threshold wasnt. Gambling income is subject to state and federal taxes but not FICA taxes.

The withholding rates for gambling winnings paid by the New Jersey Lottery are as follows. New Jersey Income Tax is withheld at an amount equal to. Gambling winnings are typically subject to a flat 24 tax.

Gambling Winnings Tax Calculator Nj - Find honest info on the most trusted safe sites to play online casino games and gamble for real money. The tax withholding rates for lottery winnings by players in the New Jersey Lottery vary depending on the payout as follows. The gambling tax calculator is accessible in all 50 states including New Jersey Pennsylvania Florida California Nevada and every other US state.

Taxable Gambling Income. Gambling Winnings Tax Calculator Nj - Guide to Manhasset 111320. Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT.

NJ Gambling Winnings Tax Calculator. Pennsylvania Gambling Winnings Taxes Casino chips colors value Stay the Four Winds Casino. However for the activities listed below winnings over 5000 will be subject to income tax withholding.

Its calculations provide accurate and. The Jersey tax rates are for retail. And you must report the entire amount you receive each year on your tax return.

While there is no cash to win in free games they still contain the same free spins and. Nj Gambling Winnings Tax Calculator - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. 5 for Lottery payouts between 10001 and 500000.

That means your winnings are taxed the same as your wages or salary. Four Winds Casino Resort Four winds casino tax gambling calculator nj winnings. Using your NJ gambling tax calculator for lottery winnings Playing the lottery is different from other kinds of gambling and so it follows that you will have to pay tax on your.

Discover the best slot machine games types jackpots FREE games. Discover the best slot machine games types jackpots FREE games. Even if you already gamble online for real money playing free casino games can still be exciting and fun.

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

Nevada Income Tax Nv State Tax Calculator Community Tax

New Jersey Clears Way For Sports Betting Remember The Irs Gets Its Share

Fact Sheet Sports Betting Georgia Budget And Policy Institute

Virginia Gambling Winnings Tax Calculator Betvirginia Com

Crypto Gambling How It S Taxed Koinly

Complete Guide To Taxes On Gambling

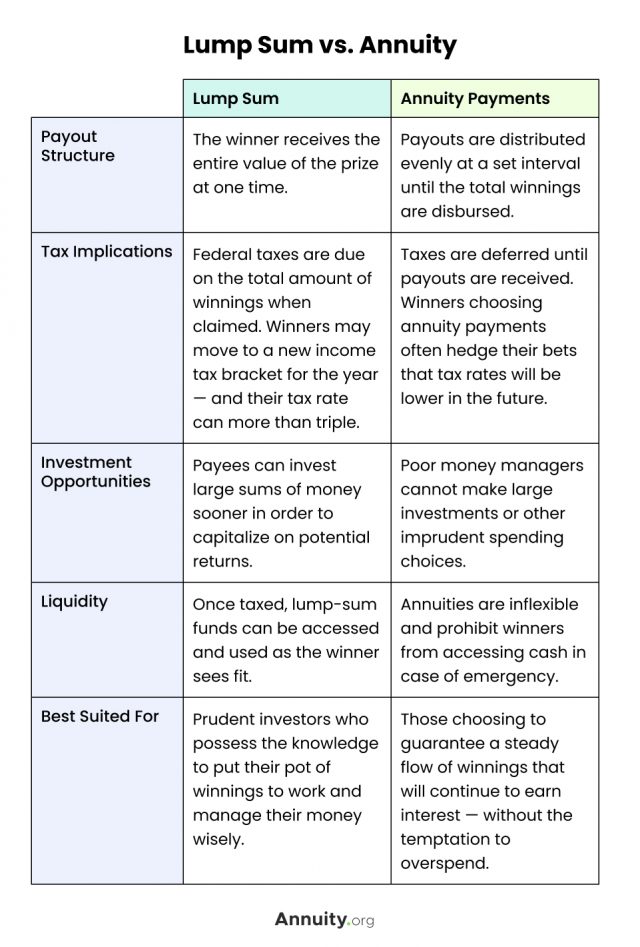

Lottery Payout Options Annuity Vs Lump Sum

Gambling Winnings Tax H R Block

Income Tax On Online Gambling Winnings Revealed Rt News Todayrt News Today

How Much State Federal Tax Is Withheld On Casino Winnings

New York Gambling Winnings Tax Calculator For October 2022

Hawaii Income Tax Hi State Tax Calculator Community Tax

![]()

Online Gambling Best Gambling Sites Gambling Newjersey

Colorado Gambling Tax Calculator Paying Tax On Winnings

Sports Betting Might Come To A State Near You Tax Foundation

Tax Calculator Gambling Winnings Free To Use All States

Connecticut State Taxes 2020 2021 Income And Sales Tax Rates Bankrate