owe state taxes from unemployment

You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for the. Unfortunately if you owe back taxes to the IRS you will find yourself in a position you do not like.

Do I Have To File State Taxes H R Block

How Taxes on Unemployment Benefits Work.

. If you owe previous taxes the IRS might already be looking at your file. Avoid penalties and interest by getting your taxes forgiven today. If you actually owe unpaid taxes to the IRS or think you may owe unpaid taxes you can call the IRS directly at 800-829-1040.

Free Case Review Begin Online. Unemployment checks dont have taxes withheld which leads most people to believe that they wont owe taxes on them come April 15th. January 27 2021 753 AM.

Ad You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. The last thing most people want or need is to get audited. Previous Owed Taxes Can Cost You.

Know Your Options So You Can Protect Your Rights. At the federal level thats also true. And sometimes they dont benefits.

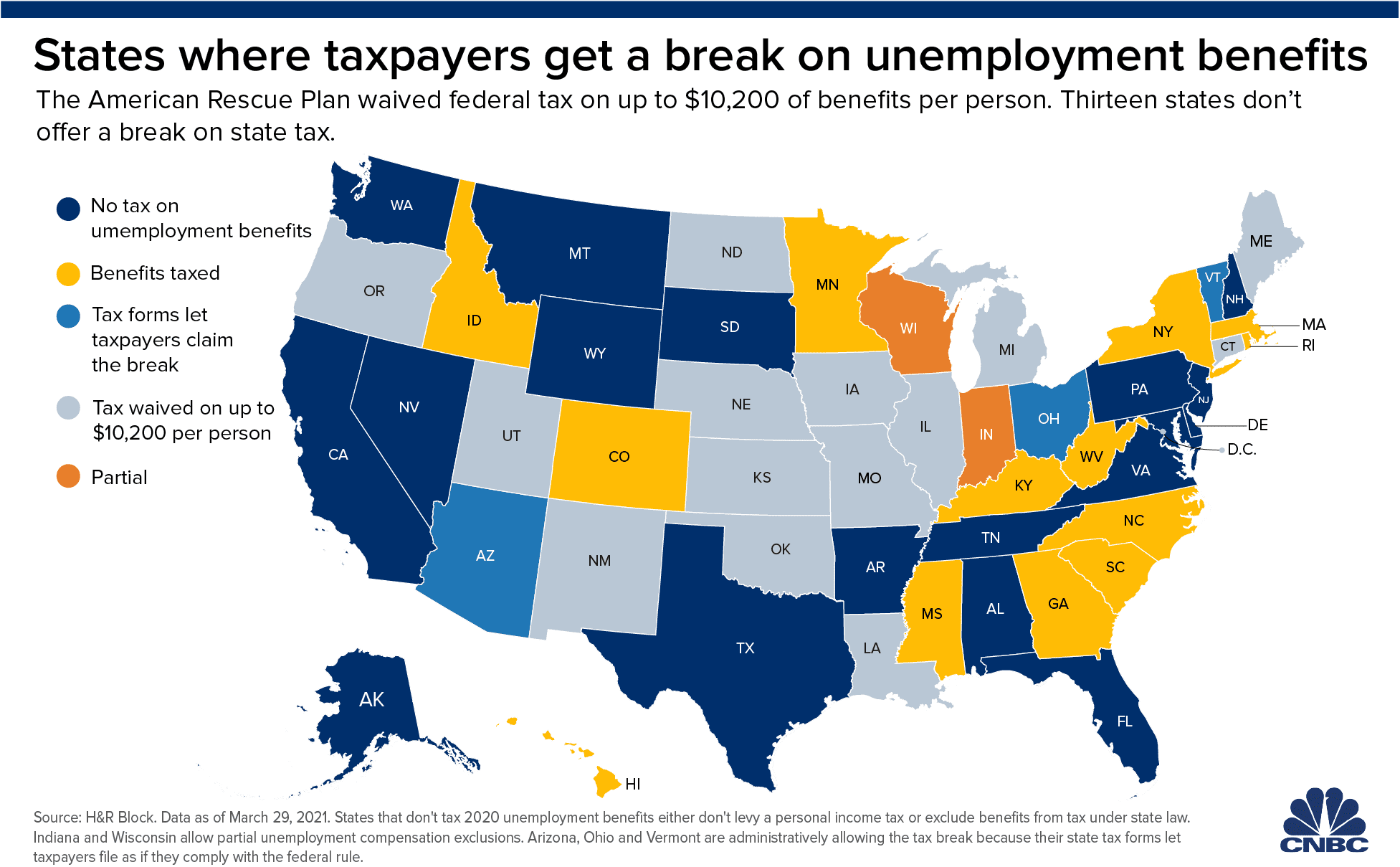

While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary. If you did not pay enough taxes on your unemployment during the year you may have to pay additional taxes on it when you complete your tax return. At the federal level thats also true.

We Have A Three-Phase Tax Relief Program That Shows Better Results Than Any Other Firm. Resolve Back Taxes For Less. Welcome to New Jersey Unclaimed Property.

According to Experian you could be taxed federally on your unemployment insurance anywhere from 0 to 37 percent. You may receive demand notices and. IRS employees at that line can help with a payment.

Ad See If You Qualify For IRS Fresh Start Program. Ad Discover A Variety Of Information About Tax Relief Companies. Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions.

Dont Let Back Taxes Owed Control Your Life in NJ. Ad File unemployment tax return. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT All unemployment claims run from Sunday to Saturday You may.

According to Experian you could be taxed federally on your unemployment insurance anywhere from 0 to 37 percent. Report unemployment income to the IRS.

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Do I Have To File State Taxes H R Block

When Are Taxes Due In 2022 Forbes Advisor

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

How Do State And Local Sales Taxes Work Tax Policy Center

I Have State Unemployment Taxes Showing Up That Are Not Due How Do I Remove Them From My Liability

Do I Have To File State Taxes H R Block

Fillable Form 4506 T Tax Forms Fillable Forms Form

How Do State And Local Individual Income Taxes Work Tax Policy Center

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Millions Of Taxpayers Getting Surprise Bills Revised Tax Statements From Irs Irs Taxes Tax Irs

I Have State Unemployment Taxes Showing Up That Are Not Due How Do I Remove Them From My Liability

Do I Need To File A Tax Return Forbes Advisor

Pin By Sandi Evans On Cool Products Tax Preparation Tax Services Tax

Tax Refunds Tax Refund Tax Services Tax Debt

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

Irs Refunds Will Start In May For 10 200 Unemployment Tax Break

Congress Wants To Waive Taxes On Unemployment Some States May Not